| Not logged in : Login |

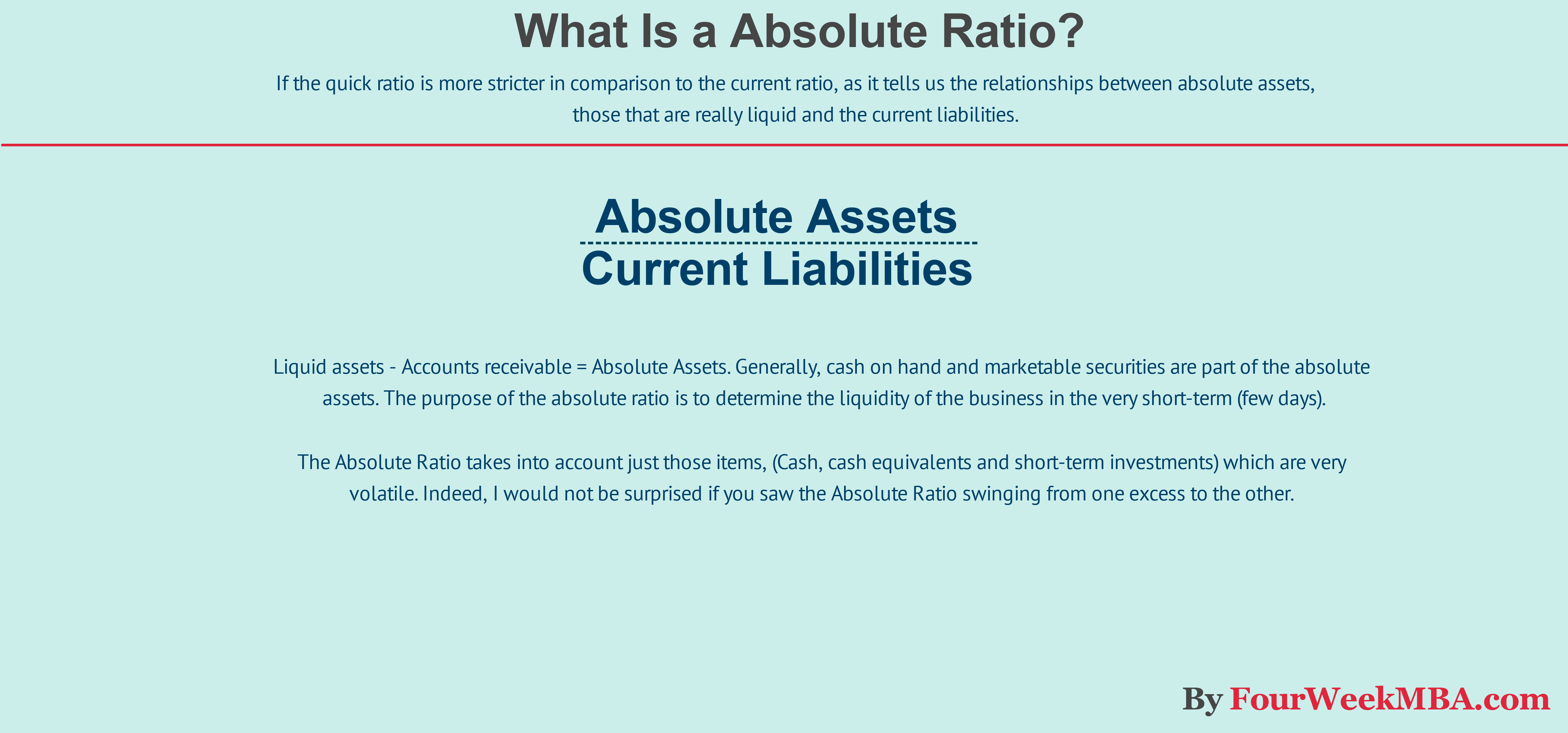

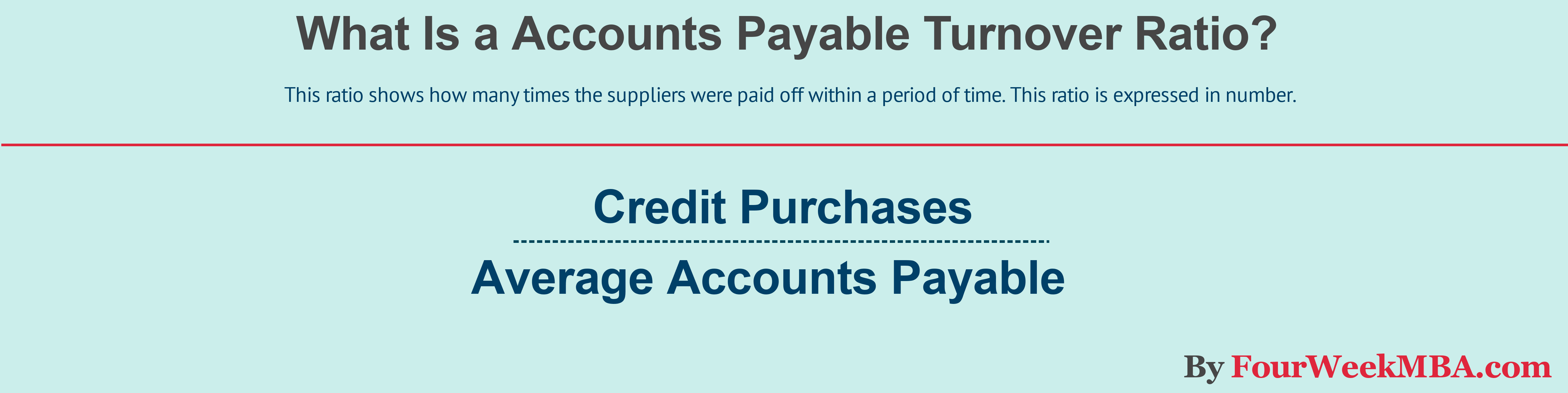

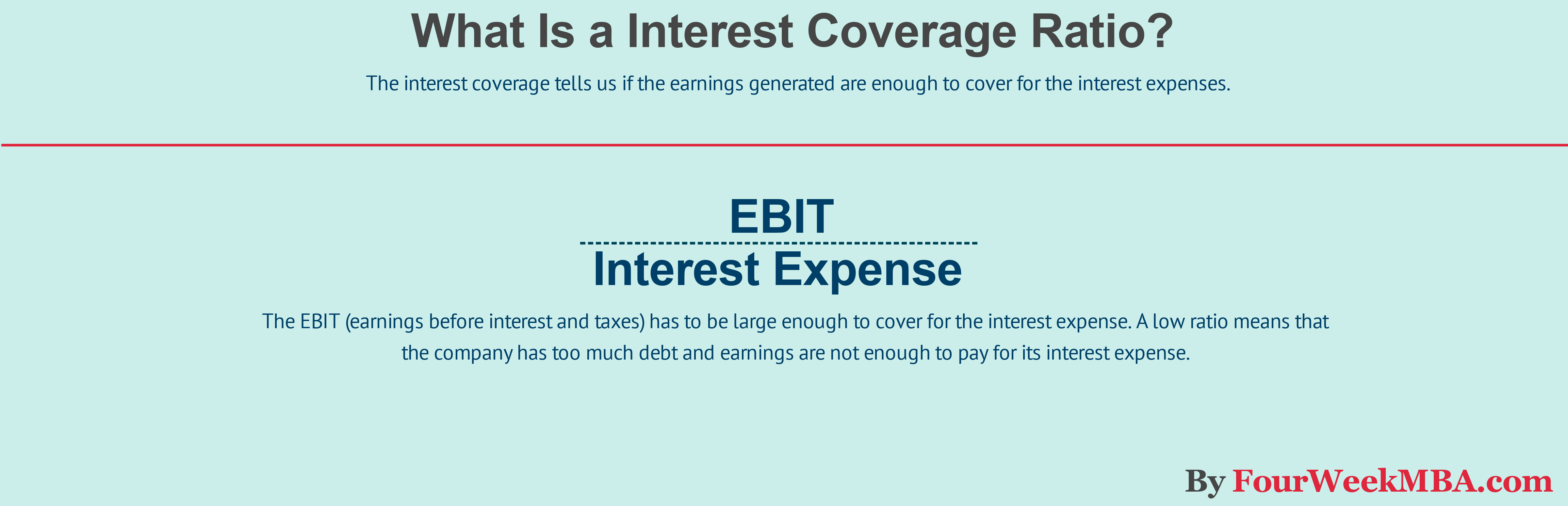

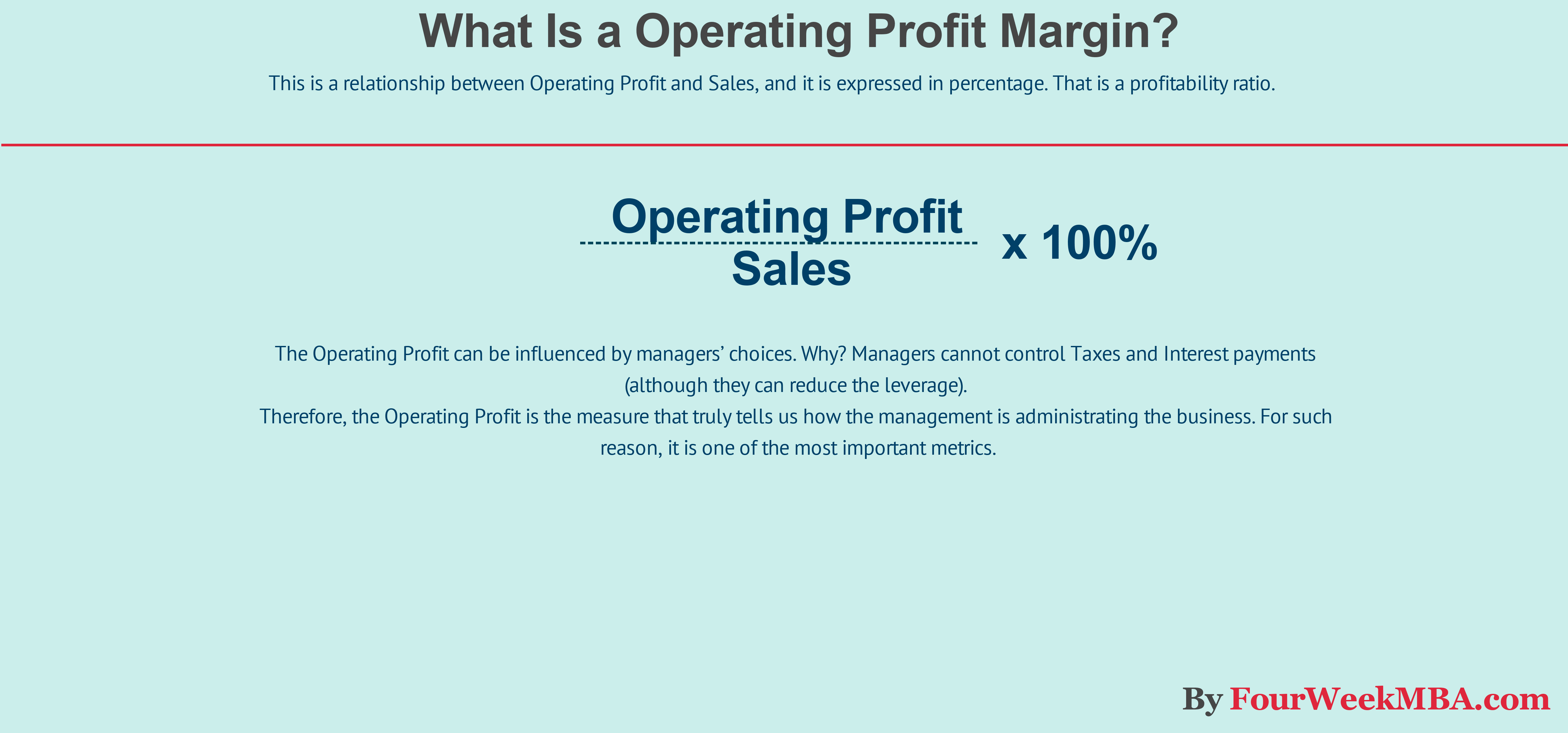

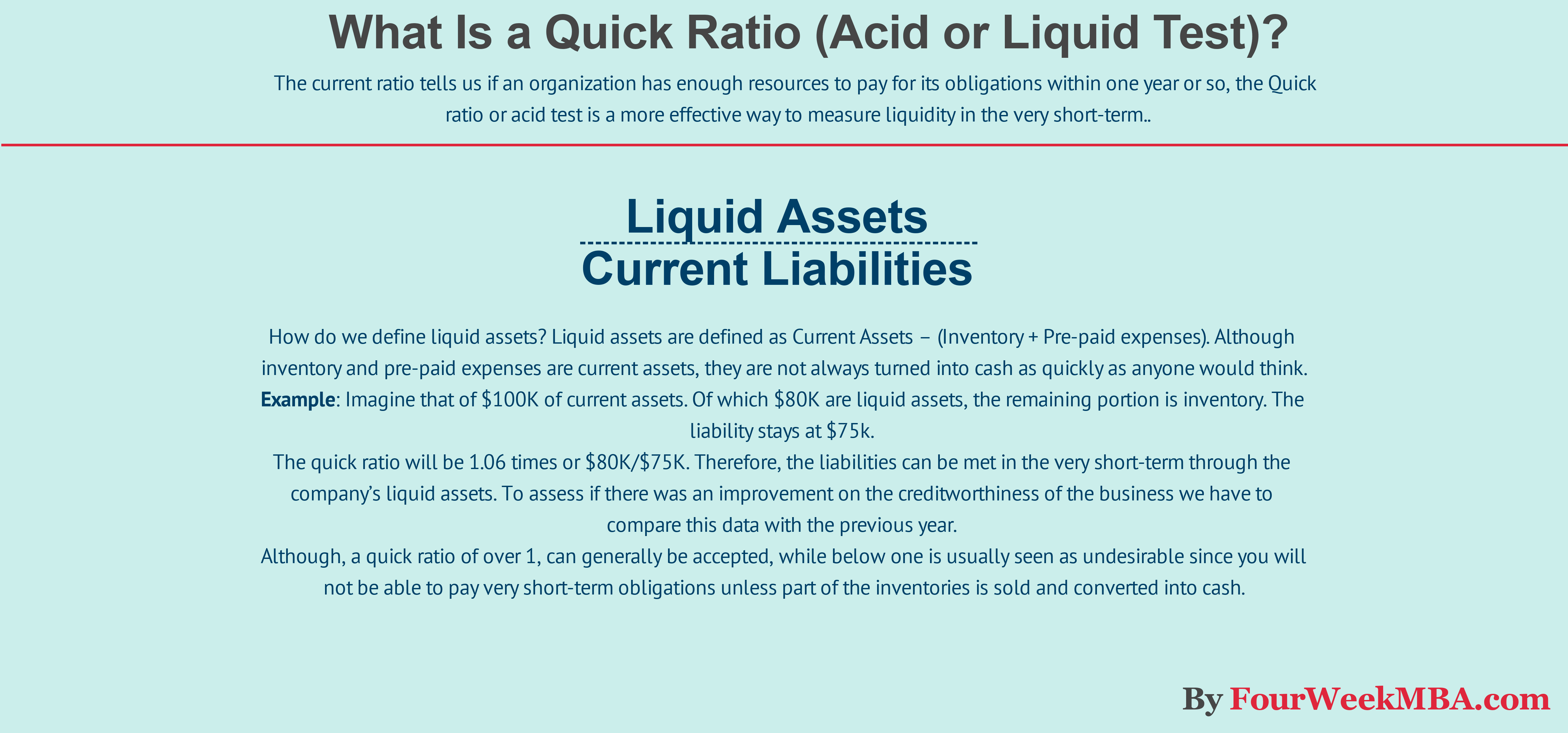

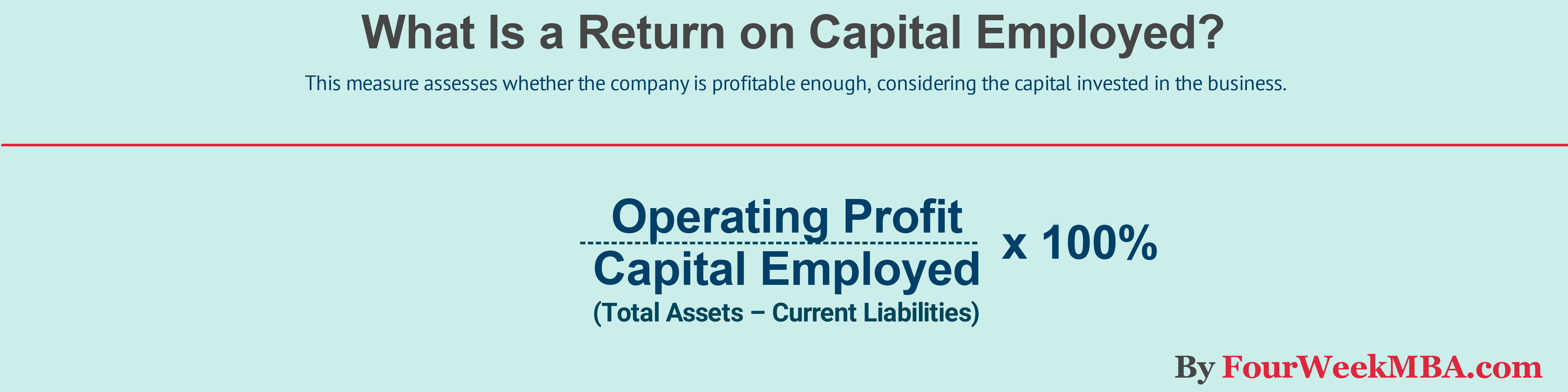

These are the most important financial ratios formulas you can use to analyze any business: current ratio absolute ratio quick ratio the accounts receivable turnover ratio the accounts payable turnover ratio inventory turnover ratio debt to assets ratio debt to equity ratio interest coverage ratio gross profit margin ratio operating profit margin ratio return on capital employed ratio return on equity ratio What is a current ratio? What is a quick ratio? What is the absolute ratio? What is the accounts receivable turnover ratio? What is the accounts payable turnover ratio? What is the inventory turnover ratio? What is a debt to assets ratio? What is a debt to equity ratio? What is the interest coverage ratio? What is a gross profit margin? What is an operating profit margin? What is a return on capital employed? What is the return on equity? Read Next: The Three Most Important Financial Ratios for the Manager 13 Financial Ratios Formulas To Analyse Any Business What Is a Financial Ratio? The Complete Beginner’s Guide to Financial Ratios What Is the Inventory Turnover Ratio? How Inventory Efficiency Can Fuel Business Growth Resources for your business: What Is a Business Model? 30 Successful Types of Business Models You Need to Know What Is a Business Model Canvas? Business Model Canvas Explained

| Attributes | Values |

|---|---|

| type | |

| label |

|

| label |

|

| sameAs | |

| Relation | |

| Description |

|

| depiction | |

| name |

|

| url | |

| http://www.w3.org/2007/ont/link#uri |

Alternative Linked Data Documents: PivotViewer | iSPARQL | ODE Content Formats:

![[cxml]](/fct/images/cxml_doc.png)

![[csv]](/fct/images/csv_doc.png) RDF

RDF

![[text]](/fct/images/ntriples_doc.png)

![[turtle]](/fct/images/n3turtle_doc.png)

![[ld+json]](/fct/images/jsonld_doc.png)

![[rdf+json]](/fct/images/json_doc.png)

![[rdf+xml]](/fct/images/xml_doc.png) ODATA

ODATA

![[atom+xml]](/fct/images/atom_doc.png)

![[odata+json]](/fct/images/json_doc.png) Microdata

Microdata

![[microdata+json]](/fct/images/json_doc.png)

![[html]](/fct/images/html_doc.png) About

About

![[RDF Data]](/fct/images/sw-rdf-blue.png)

OpenLink Virtuoso version 08.03.3332 as of Oct 28 2024, on Linux (x86_64-generic-linux-glibc25), Single-Server Edition (7 GB total memory, 5 GB memory in use)

Data on this page belongs to its respective rights holders.

Virtuoso Faceted Browser Copyright © 2009-2024 OpenLink Software